What we do …

CreDec is business internet banking the way it should be; seamless, automated, secure and real time… which works around us.

Steve

CreDec Customer

All payments, in one place.

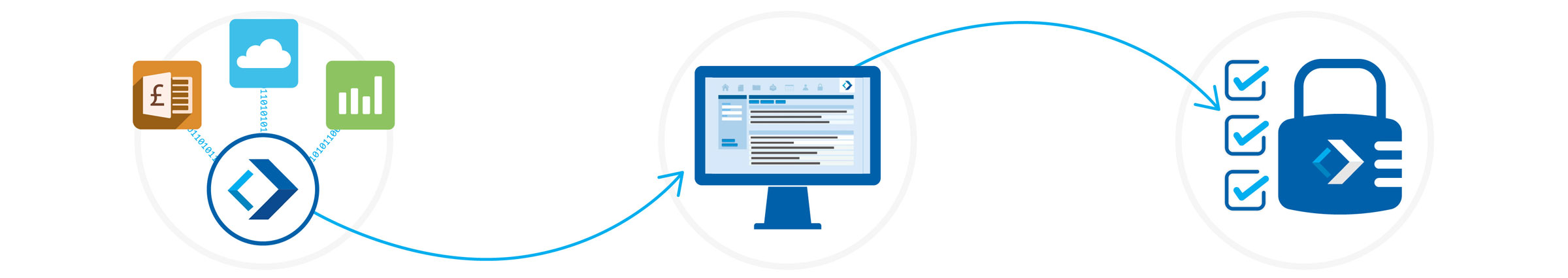

Our platform makes it easy to automate all business bank to bank payments, securely.

We integrate with your favourite cloud accounting providers, like Xero – so you don’t have to – to allow seamless payment management for all users who support payroll, accounting and banking.

It doesn’t replace the business bank account but sits above it – there’s no set up and it works with any online bank account.

We make collaboration easy, so accountants and bookkeepers can provide a total solution to all bank payment related activity, not just payroll, however their clients require. Every CreDec customer has their own workflow and approvals process, to fit the way they work, as it should. We let every business, whatever its size, work in big ways.

CreDec delivers significant cost saving and efficiencies and drives wider benefits of stronger cash flow, reporting and productivity.

Seamless, integrated payments transforming the way business works.

All payments, in one place.